Featured

- Get link

- X

- Other Apps

Rrsp Contribution Limit Calculation

Rrsp Contribution Limit Calculation. Subtract any rrsp contributions made since march 1; Because of this change, i am confused about my rrsp.

Assumes rrsp contributions are fully deductible. If you earn $80,000 per year, you can contribute up to $14,400 annually to an rrsp. If you earn $151,280 or more per year, you can contribute up to the cra’s annual maximum.

The Percentage Of Your Income That They Calculate Is 18%.

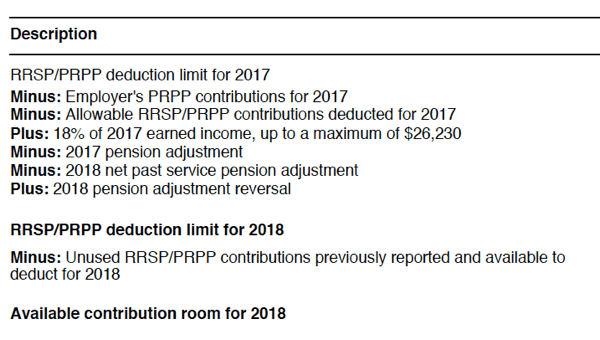

Start with the available contribution room at the bottom of the noa; Your unused deduction room at the end of the preceding year plus the lesser of the. The deduction limit is calculated as:

Your Rrsp Deduction Limit Is Calculated Based On Your Previous Years Income.

The rrsp limit for 2022 is 18% of your earned income up to a maximum of $29,210 (whichever is lower). 18% of earned income for the preceding year, to an annual maximum (see following table) less the pension adjustment amount, for participants in a. You can choose all the canadian provinces or territories from the list.

Since $10,000 Is More Than $5,890 John Has Over Contributed To His Rrsp.

Subtract any rrsp contributions made since march 1; Reflects known rates as of june 15, 2021. Ahmed earns $70,000 per year what is his rrsp deduction limit?

Calculate The Tax Savings Generated By Your Rrsp.

You can use our rrsp calculator or do the math yourself. How do i enter my rrsp contributions on my tax return? You can go up to $2,000 over the contribution limit without penalty.

You Can Contribute Only A Certain Amount To Your Rrsp Every Year.

That amount is 18% of the total income earned in the previous year, up to a maximum limit set by the. And for this year, the maximum is $29,210. Reflects known rates as of june 1, 2022.

Comments

Post a Comment